I met Mark Maiocca at boxing. My gym is co-owned by a group of cousins who grew up Nonantum. He’s not a cousin but also grew up with this crew, hence he grew up boxing too.

Mark Maiocca looks tough here but he’s really a nice guy!

He’s usually in the gym training on the heavy bag when I am training and he’s always been very friendly and supportive so I usually chat with him for a few minutes every time I see him.

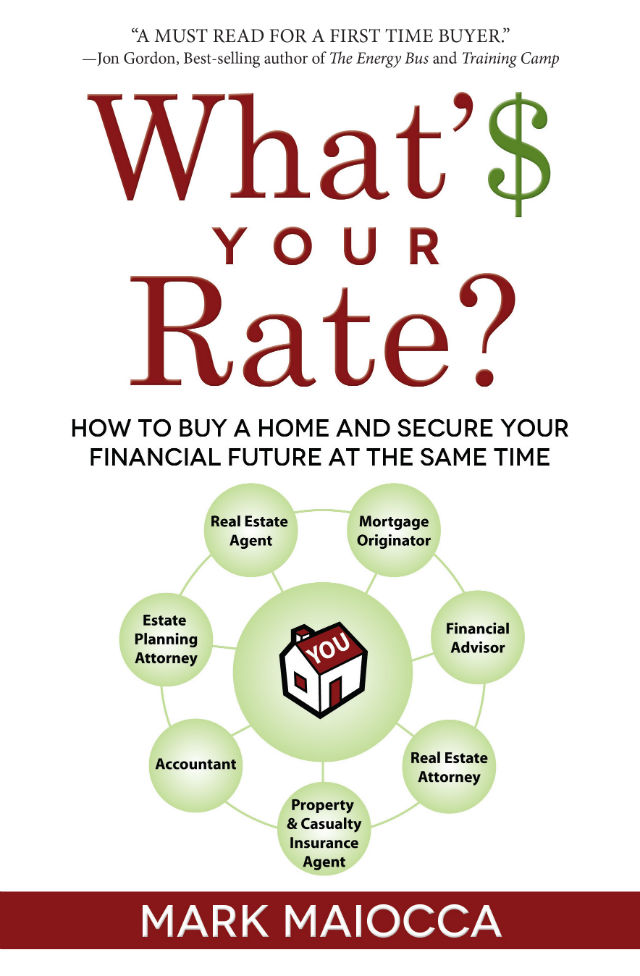

Have you assembled a “Core 7” team of advisors? Mark shows you how. Boxing training is not part of the Core 7 but also helpful!

Recently, I figured out that he was in mortgage but I had no idea that he wrote a book! What’$ Your Rate? is perfect for first time home buyers.

What’$ Your Rate? by Mark Maoicca

I asked him about it and this is what he said:

WHAT THE BOOK IS ABOUT?

What’$ Your Rate? offers a unique perspective into the process of buying a home. It also helps you to formulate a financial plan and put together your financial team. Don’t neglect to consider your insurance needs, investment strategies, college funding, estate planning or passing on the legacy. These critical factors are often overlooked while transacting what is, for most people, the single largest purchase they will ever make — their home.

This definitive guide is unique in that all of the home buying and financial planning information is related through a compelling narrative centered on the young family, a family probably a lot like yours. They have grown out of their apartment and they are expecting a third child. After a discouraging beginning into the home buying process, they follow the advice of a trusted friend, and an all-encompassing plan soon emerges.

Learn how to assemble your team of trusted advisors and put together a comprehensive plan for the future. This is a must read for anyone considering buying a home and for the “Core 7” business professional looking to create a system to help in that endeavor.

WHY I WAS INSPIRED TO WRITE THE BOOK?

After looking at 10,000 loans in my career, while covering an affluent market, I can only count on one hand the number of clients who had a full “Core 7” financial team in place. The “Core 7” professionals are: the real estate agent, the mortgage originator, the real estate attorney, the financial advisor, the accountant, the property and casualty insurance agent, and the estate planning attorney.

This shows me that even though there is more financial information on the internet then there ever was, people are no better off.

MY PREDICION FOR THE MARKET?

I feel that mortgage rates will stay in a competitive range for the foreseeable future. The Federal Reserve has stopped purchasing mortgage backed securities, so we could see a small jump in interest rates going into next year. However I don’t interest rates going up significantly, as a sudden rate increase like that would damage the economy. I see interest rates staying in a .250-.375 range until Spring. Opportunities to refinance and purchase at great rates will continue to benefit homeowners.

THE OPPORTUNITY THAT MOST PEOPLE MISS:

The No Points No Closing Cost Refinance. This is truly a no cost loan as the lender is paying all of the fees associated with the loan for you. The savings is FREE MONEY!!!

It is such a great opportunity to capitalize on this. I tell my clients that they are “taking profits off the table.” The best opportunity is to immediately have this savings contributed on a monthly basis which is called dollar cost averaging towards another important financial investment. For this example let’s assume the savings would be contributed to a retirement fund.

Example:

$300,000 loan at 4.5%

Monthly Payment= $1,514

Refinance to 4.25%

Monthly Payment= $1,470

Savings=$44

Invested into a retirement fund @ 8% over 30 years =$66,013

BUT there’s more…..let’s say you can contributed to your 401k or 403b before tax Let’s say you are in the 25 percent tax bracket you could invest $58 a month.

$58 invested into a retirement fund @ 8% over 30 years =$87,017.

Is it worth it?

These are the types of exercises and situations that I want my readers to think about when considering buying a home. I want them to look at their entire financial picture in order to make an informed decision.

I hope that you find this intro to my book useful. I am giving away three signed copies. Please fill out the Rafflecopter below to enter.

Win a Copy of What’$ Your Rate?: 3 Winners!

Please fill out the Rafflecopter.

As an Amazon Associate, I earn from qualifying purchases.

Leave a Reply